Despite calls for its renewal, Congress hasn’t addressed the issue of the popular residential energy credit, which officially expired after 2017. This credit, which is generally equal to 10% of the cost of qualified energy-saving improvements made to a principal

Read more →Personal Finance

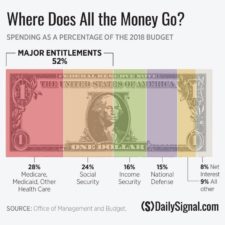

Here’s a breakdown of how the US Government spends your tax dollars…it may not be the way you think.

Read more →Just under 500 lawsuits were filed in 2018 in federal courts across the country by private attorneys seeking money for the federal government.

The lawsuits are a mostly unknown part of an industry of private collectors working on behalf of the federal government to track down student loan payments. It’s a system that showcases how student loan debt is different from all other kinds of debt: It can’t be written off in bankruptcy and, because it’s owned by the federal government, long-term unpaid debt is never written off, but relentlessly tracked down.

Read more →The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $55,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Read more →No one wants a visit from the Internal Revenue Service. But if you get too generous with your calculations, you may need to back up your tax return.

Read more →Chances are a big portion of your retirement savings are in pretax accounts like a 401(k) or IRA. If you need to tap those accounts for costly care, you must realize that every dollar is taxable. And you might be shocked at the tax rates that come with withdrawals large enough to foot the bill.

Read more →Required minimum distributions are a bane of retirement for many Americans. The concept puzzles many people, and the rules can be complicated. The result is that many people fail to take their required minimum distributions (RMDs) or they take the wrong amount. The IRS noticed this a few years ago and decided to change the information reported to it and how it is analyzed so it can better identify people who don’t take the correct RMDs.

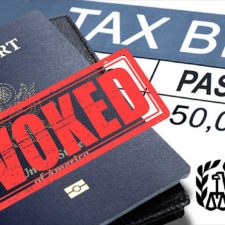

Read more →What You Need to Do If You Plan to Travel Abroad and Have Unpaid Federal Taxes WRITTEN BY: Rosenberg Martin Greenberg LLP Last week, the Internal Revenue Service (“IRS”) published another friendly reminder that it was recently vested with the

Read more →It’s not your imagination: It really is a different kind of tax season. It’s so different that the National Taxpayers Union Foundation (NTUF), a nonpartisan research and educational organization, is calling on Congress to extend the filing season. by Kelly Phillips

Read more →You can maximize your tax refund in several ways — from paying off high-interest debt to investing in a business or saving for retirement. One or more of these options could be the perfect fit for you.

Read more →TOPICS IN THIS ISSUE: NEW! For 2019…Tax Videos to help you understand new tax laws and deal with special situations. Surprise, no tax refund for you! What not to do if you owe the IRS. 5 Personal Finance Podcasts Actually

Read more →Most Americans end up getting a tax refund each year, but if you underpay your taxes, whether intentionally or not, you’ll wind up in the opposite scenario — owing the IRS money. This is especially likely to happen if you earned a lot of secondary income from a side job or investments.

Read more →“To me, the best personal finance podcasts give useful, actionable advice,” said Kevin Goldberg, founder of Discover Pods. “There are too many out there that simply give canned obvious suggestions that aren’t worth your time to listen to.”

Read more →This is turning out to be a difficult year for a lot of taxpayers.

Major tax law changes that took effect last year are impacting people’s beloved refunds. The Internal Revenue Service reported that, as of Feb. 1, refunds are down 8.4 percent. The average refund was $1,865, compared with $2,035 for the same period a year ago.

Read more →If you tend to procrastinate about filing your tax return, this is not the year to dawdle.

Usually everyone is fixated on April 15, when federal tax returns are typically due. But this tax season, Feb. 15 is the looming date on your calendar. That’s the day when the temporary funding ends for the federal agencies that were shut down for more than a month

Read more →