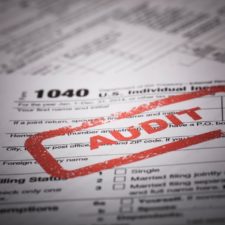

It is only natural to worry about an IRS audit, and the duration of audit periods can be downright frightening. Tax lawyers and accountants are used to monitoring the duration of their clients’ audit exposure, and so should you.

Read more →Tax Fraud

No one wants a visit from the Internal Revenue Service. But if you get too generous with your calculations, you may need to back up your tax return.

Read more →TOPICS IN THIS ISSUE: IRS Releases New Not-Quite-Postcard-Sized Form 1040 For 2018, Plus New Schedules Tax Trends Heading Into 2019 White House Says IRS Will Pay Tax Refunds During Government Shutdown AICPA and NCCPAP ask IRS to suspend tax penalties

Read more →TOPICS IN THIS ISSUE: Individuals Who Need to Reconstruct Records After a Disaster IRS Warns About Tax Scams Related To Hurricanes, Wildfires & Vegas Shooting Tax Refund Fraudsters Already Had Much Of That Equifax Stolen Data Taxpayers Who Are Victims

Read more →White collar defense attorneys and accountants engaged to assist in investigations conducted by the IRS Criminal Investigation Division are familiar with these words: “… the tax loss … is … $550,000 to $1,500,000 …” By Edward M. Waddington and Ricardo J.

Read more →Is your tax return at risk for ID theft?

While IRS reports progress on cracking down on tax-related ID fraud, consumers and businesses warned to watch out for con artists who want more of your data.

Read more →The Internal Revenue Service is warning taxpayers about tax and information-stealing scams that continue to be reported around the country. Phishing, phone scams and identity theft top the list of items normally reported. However, following hurricanes and other disasters, the

Read more →The unmarked vehicles arrived in the morning. More than 20 armed agents poured out. Hours later, Mii’s Bridal & Tuxedo was out of business after serving customers for decades. Its entire inventory of wedding gowns and dresses as well as

Read more →