Use the Tax Withholding Estimator to perform a quick “paycheck checkup.” This is even more important following the recent changes to the tax law for 2018 and beyond.

Read more →Tax Planning

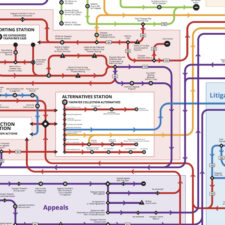

The National Taxpayer Advocate released the convoluted map to draw attention to a frustrating system By ANDREW KESHNER Got a problem with your taxes? Get ready for a long and winding road. A new “roadmap” charts the labyrinth inside the

Read more →Taxes can be boring and complicated, but they’re also a part of life. Anyone who works has to pay them, and if you’re not careful, you could wind up with a major problem on your hands. Here, in fact, are three major tax mistakes that could really come back to bite you.

Read more →The law known as the Tax Cuts and Jobs Act (TCJA) addressed the individual tax rate bracket structure’s previous contribution to a marriage tax penalty by equalizing married filing jointly tax amounts with those of two single individuals combined (each with half the amount of taxable income of the joint filers), up to the bottom threshold of the highest tax bracket.

Read more →by McNair Law Firm, P.A. The United States has a voluntary income tax reporting system. U.S. citizens, permanent residents, and businesses here must annually file income tax returns with the IRS, reporting their “worldwide income”, deductions, and their “net taxable income”,

Read more →IRS Special Edition Tax Tip 2017-01, January 17, 2017 Taxpayers have fundamental rights under the law. The “Taxpayer Bill of Rights” presents these rights in 10 categories. This helps taxpayers when they interact with the IRS. Publication 1, Your Rights

Read more →Thanks for visiting our great new website! Built by San Diego WordPress specialist Edward A. Sanchez of Brass Ring Multimedia, this site uses WordPress, the top content management system (CMS). WordPress makes it extra easy for us to provide you with great information,

Read more →New IRS Publication Helps You Find out if You Qualify for a Health Coverage Exemption IRS Health Care Tax Tip 2014-19, Sept. 23, 2014 You may read the full article HERE on Internal Revenue Service’s Website Taxpayers who might qualify

Read more →You may be able to deduct certain miscellaneous costs you pay during the year. Examples include employee expenses and fees you pay for tax advice. If you itemize, these deductions could lower your tax bill. IRS Summertime Tax Tip 2014-19,

Read more →If you work from home, you should learn the rules for how to claim the home office deduction. Starting this year, there is a simpler option to figure the deduction for business use of your home. The new option will

Read more →Some people must pay taxes on part of their Social Security benefits. Others find that their benefits aren’t taxable. If you get Social Security, the IRS can help you determine if some of your benefits are taxable. IRS Tax Tip

Read more →