It isn’t easy to settle your tax debts for less than you owe, but it is possible. Here is what taxpayers need to know

Here is an idea that probably sounds like a guaranteed waste of time: Ask the Internal Revenue Service to settle your tax debts for less than you owe.

By Tom Herman

For most people, that may sound far-fetched. But for some people drowning in debt or struggling with other seemingly insurmountable financial woes, persuading the IRS to accept a compromise offer may not be as hopeless as it seems.

While the IRS isn’t known for its generosity, it is authorized by law to compromise under certain circumstances. For example, the IRS “generally” will accept a compromise offer “when the amount offered represents the most we can expect to collect within a reasonable period,” says Eric Smith, an IRS spokesman. A compromise is a possibility if “you can’t pay your full tax liability, or doing so creates a financial hardship,” the IRS says on its website.

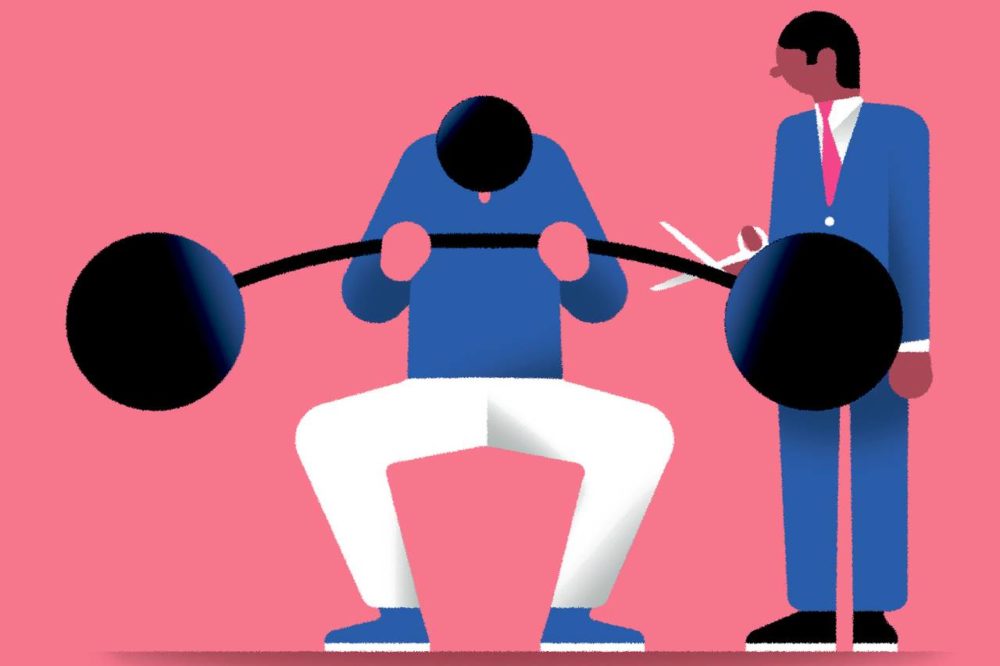

But getting to “yes” can be stunningly complicated and time-consuming. Filling out the application, collecting documentation and waiting for an IRS response can require extraordinary patience. “It’s typically a long haul due to the unfortunate underfunding of the IRS by Congress and the process the examiners must go through to analyze each offer,” says Fran Obeid, an attorney at MFO Law, P.C., in New York City.

Critics say the IRS could make the program more user-friendly, including responding more quickly to offers and being less stingy. The IRS has said that determining someone’s “reasonable collection potential” is a “complex and nuanced topic,” and that it has made improvements, including posting more information on its website. Officials also say they are reviewing the subject and will consider changes based on the findings.

Here are answers to some questions readers may have.

How many compromise offers does the IRS receive in a typical year, and how many are accepted?

- When My Money and Your Money Becomes Our MoneyThere are a lot of reasons for couples to combine their finances. And a lot of reasons why it can be difficult.CLICK TO READ STORY

- The Best Financial Advice I Ever GotWe asked financial experts to tell us the piece of guidance that has made the biggest difference in their lives. Here’s what they had to say.CLICK TO READ STORY

- Forget the 401(k). Let’s Invent a New Retirement Plan.For starters, make it portable, allowing your savings to follow you wherever you go or however you work.CLICK TO READ STORY

- The Biggest Ways People Waste MoneyThey run the gamut, from the smallest things (coffee, anyone?) to the largest (do you really need that big house?)CLICK TO READ STORY

- It’s Time to A/B Test Your Financial LifePeople often don’t know their true preferences, from where to eat to when to retire. There’s a simple solution to this—and it could save you a lot of money.CLICK TO READ STORY

- How Much Money Will You Really Spend in RetirementMost of us vastly underestimate the percentage of income we’ll need. Here’s how you can make sure to get that number right.CLICK TO READ STORY

- The High Financial Price of Our Short Attention SpansWe’re bombarded with information, giving us little time to focus on any of it. It’s a recipe for making bad choices about our money.CLICK TO READ STORY

MORE IN WEALTH MANAGEMENT

During the year ended Sept. 30, 2018, the IRS accepted about 24,000 offers out of 59,000 received, Mr. Smith says. Those numbers, which include individual taxpayers and businesses, are…

Leave a Reply

You must be logged in to post a comment.