What You Need to Do If You Plan to Travel Abroad and Have Unpaid Federal Taxes

What You Need to Do If You Plan to Travel Abroad and Have Unpaid Federal Taxes

WRITTEN BY: Rosenberg Martin Greenberg LLP

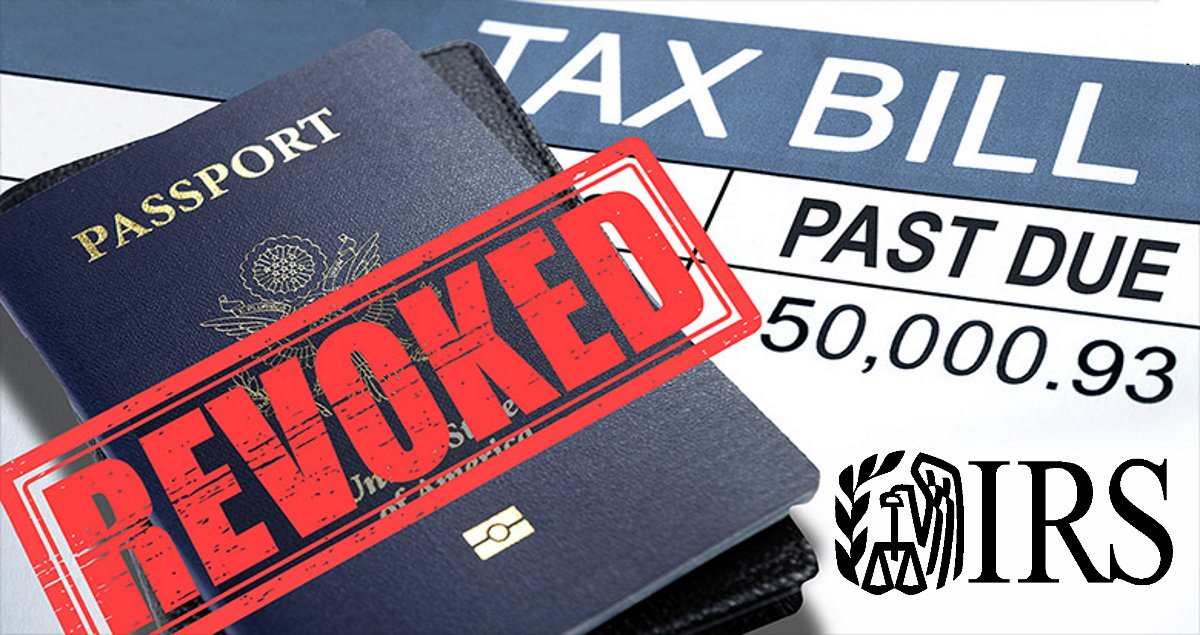

Last week, the Internal Revenue Service (“IRS”) published another friendly reminder that it was recently vested with the authority to revoke passports and deny passport applications for those with “seriously delinquent tax debts.” Within that notice, the IRS reminded taxpayers that they may not be able to obtain or renew passports if they owe federal taxes. The IRS also advised these taxpayers that they should “take prompt action to resolve their tax issues.” Potentially affected taxpayers – i.e., those with unresolved tax liabilities – should have a thorough understanding of the boundaries of I.R.C. § 7345 and IRS collection procedures before contacting the IRS.

What You Need to Do If You Plan to Travel Abroad and Have Unpaid Federal Taxes

What You Need to Do If You Plan to Travel Abroad and Have Unpaid Federal Taxes

Leave a Reply

You must be logged in to post a comment.