The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $55,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Read more →Posts Tagged 1040

Required minimum distributions are a bane of retirement for many Americans. The concept puzzles many people, and the rules can be complicated. The result is that many people fail to take their required minimum distributions (RMDs) or they take the wrong amount. The IRS noticed this a few years ago and decided to change the information reported to it and how it is analyzed so it can better identify people who don’t take the correct RMDs.

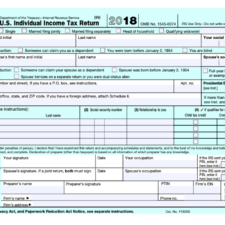

Read more →Kelly Phillips Erb Senior ContributorTaxes Remember those postcard-sized tax returns? They’re here. Sort of. They’re not exactly postcard-sized, but the new form 1040 is smaller than before. The Internal Revenue Service (IRS) has made the new form 1040 and the accompanying

Read more →