TOPICS IN THIS ISSUE: Stretch Your Retirement Savings With Multi-Year Planning IRS Audit Period is 3 Years, 6 Years Or Forever: How To Cut Your Risk Be Like A Bank. Test Yourself To See How Your Finances Would Hold Up

Read more →Personal Income Tax

The goal of tax-loss harvesting to lower your overall taxes. With proactive tax planning, you may be able to lower your taxable income by selling off losing investments. Similarly, you can offset some long term gains by selling investments that may have lost money over the long term.

Read more →Middle-class families spend nearly $13,000 per child every year. Learn how to budget strategically.

Read more →To help reduce your tax burden once you retire, and free up more money for expenses and fun, give income planning a try. Here are four ways to adjust your income and get a better grip on your tax bill.

Read more →The Internal Revenue Service (IRS) has announced that a new payment option has been added to the private debt collection program. The payment option is intended to make it easier for those who owe to pay their tax debts, although some practitioners, like me, fear that it could lead to abuse.

Read more →It is only natural to worry about an IRS audit, and the duration of audit periods can be downright frightening. Tax lawyers and accountants are used to monitoring the duration of their clients’ audit exposure, and so should you.

Read more →TOPICS IN THIS ISSUE: Benefits Of Starting Your Tax Planning Early In the Year What To Do If You’re Audited By the IRS 13 Advantages Of Keeping Personal And Business Bank Accounts Separate Ins And Outs of Settling With the

Read more →It isn’t easy to settle your tax debts for less than you owe, but it is possible. Here is what taxpayers need to know Here is an idea that probably sounds like a guaranteed waste of time: Ask the Internal

Read more →Mixing one’s funds with the proceeds of a business is a tempting prospect. For many solopreneurs, commingling allows them to have a much simpler time when banking. However, situations may arise where mixing business funds with personal funds can lead to a complicated mess. While the actual business of banking is easier, things like account-keeping, tax reporting and separating business expenses from private earnings become a nightmare.

Read more →“Gasp!” That might be your first reaction to seeing an envelope with an eagle on the upper left corner and the dreaded words next to it: Internal Revenue Service. But fear is not an emotion that should flow through your body. Why not? Well, if you’ve accurately recorded what properly belongs on your tax return, you have nothing to fear from the IRS if they contact you about an audit.

Read more →Most individuals begin tax planning when the due date for filing income tax return is around the corner. However, it is prudent to start your tax planning earlier as it gives you more time to make a good estimate of your income and gains.

Read more →TOPICS IN THIS ISSUE: 12 Small Business Tips From Podcasts Used By the Pros Top Ten Money Mistakes People With Modest Incomes Make Should Financial Success Be Your Ultimate Goal? Tax Witholding Estimator The IRS Will Waive This 2018 Penalty

Read more →Use the Tax Withholding Estimator to perform a quick “paycheck checkup.” This is even more important following the recent changes to the tax law for 2018 and beyond.

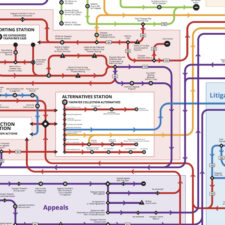

Read more →TOPICS IN THIS ISSUE: 3 Costly Tax Mistakes to Avoid 6 Summertime Uses For This Tax-Favored Savings Account Understanding How Taxpayers May Appeal to the IRS Office of Appeals This Crazy Map Shows You How Complicated The Tax Code Has

Read more →The National Taxpayer Advocate released the convoluted map to draw attention to a frustrating system By ANDREW KESHNER Got a problem with your taxes? Get ready for a long and winding road. A new “roadmap” charts the labyrinth inside the

Read more →