TOPICS IN THIS ISSUE: Stretch Your Retirement Savings With Multi-Year Planning IRS Audit Period is 3 Years, 6 Years Or Forever: How To Cut Your Risk Be Like A Bank. Test Yourself To See How Your Finances Would Hold Up

Read more →Business Income Tax

It is only natural to worry about an IRS audit, and the duration of audit periods can be downright frightening. Tax lawyers and accountants are used to monitoring the duration of their clients’ audit exposure, and so should you.

Read more →TOPICS IN THIS ISSUE: Benefits Of Starting Your Tax Planning Early In the Year What To Do If You’re Audited By the IRS 13 Advantages Of Keeping Personal And Business Bank Accounts Separate Ins And Outs of Settling With the

Read more →Most individuals begin tax planning when the due date for filing income tax return is around the corner. However, it is prudent to start your tax planning earlier as it gives you more time to make a good estimate of your income and gains.

Read more →TOPICS IN THIS ISSUE: 12 Small Business Tips From Podcasts Used By the Pros Top Ten Money Mistakes People With Modest Incomes Make Should Financial Success Be Your Ultimate Goal? Tax Witholding Estimator The IRS Will Waive This 2018 Penalty

Read more →Use the Tax Withholding Estimator to perform a quick “paycheck checkup.” This is even more important following the recent changes to the tax law for 2018 and beyond.

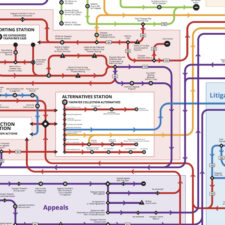

Read more →TOPICS IN THIS ISSUE: 3 Costly Tax Mistakes to Avoid 6 Summertime Uses For This Tax-Favored Savings Account Understanding How Taxpayers May Appeal to the IRS Office of Appeals This Crazy Map Shows You How Complicated The Tax Code Has

Read more →The National Taxpayer Advocate released the convoluted map to draw attention to a frustrating system By ANDREW KESHNER Got a problem with your taxes? Get ready for a long and winding road. A new “roadmap” charts the labyrinth inside the

Read more →TOPICS IN THIS ISSUE: Optimizing Residential Real Estate Deductions Tax Court Approves IRS Denial of Installment Plan Request The Marriage Tax Penalty, Post-TCJA 3 Great New Tax Videos! IRS TAX TIP: Here’s What Taxpayers Should Know Before Visiting an IRS

Read more →TOPICS IN THIS ISSUE: Tax Levy: What It Is, How It Works and How to Stop One What Is A Tax Lien? IRS corrects error in Schedule D tax calculation worksheet 3 Great New Tax Videos! IRS TAX TIP: Taxpayer

Read more →“In this world nothing can be said to be certain, except death and taxes.” – Benjamin Franklin

Your small business needs to correctly file and pay taxes – on time

That hopefully isn’t news to you. But many small business owners put off thinking about taxes until the last possible moment.

Read more →Tax levies put your assets at risk. To remove them, you’ll need to work with the IRS to pay your back taxes.

Read more →All taxpayers have fundamental rights when working with the IRS. The agency outlines them on IRS.gov and in Publication 1. To help taxpayers understand their rights, here is a list of them with a brief description of each one:

Read more →You don’t want to play chicken with the Internal Revenue Service. Tax season is over, and the vast majority of taxpayers have filed their returns and paid any outstanding taxes they owed. But for a significant number of people, paying

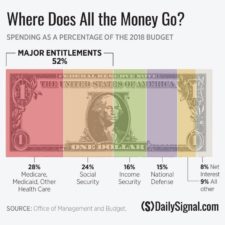

Read more →Here’s a breakdown of how the US Government spends your tax dollars…it may not be the way you think.

Read more →